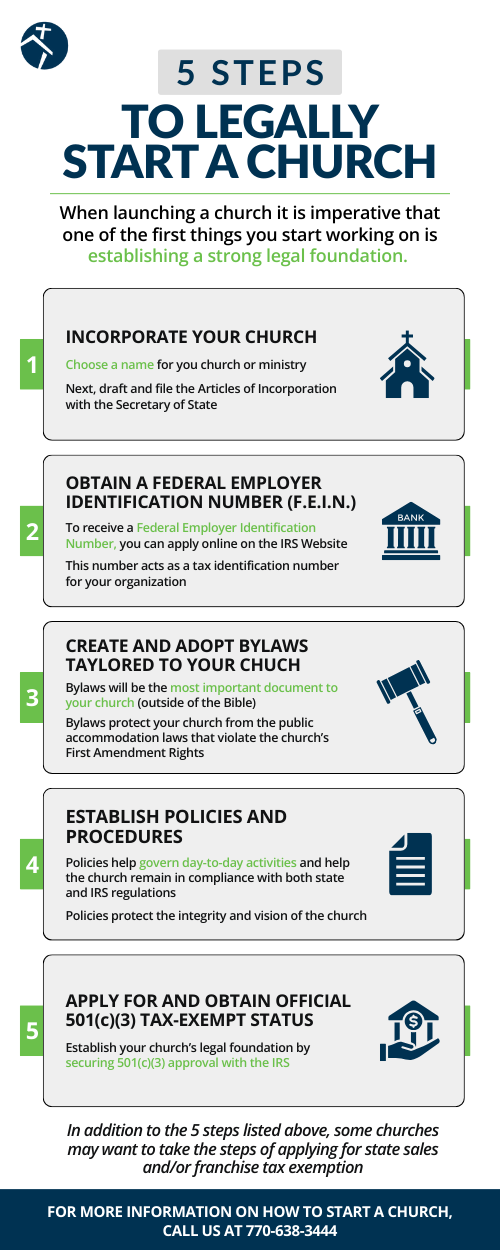

How To Start A Church: 5 Steps to Legally Start a Church

By Brandon Williams, VP of Marketing

Starting a church or ministry is an exciting calling—but it can also feel overwhelming once you realize how many legal, financial, and organizational steps are involved. From building a launch team to drafting bylaws and applying for tax-exempt status, there are critical details to get right from the very beginning.

This guide will walk you through the key steps to legally start a church or ministry, establish a strong foundation, and position your organization for long-term growth and sustainability.

Before you dive into paperwork, you’ll want to lay the groundwork for your new church.

-

Clarify your mission and beliefs: Define your purpose, vision, and doctrine. This will guide every decision you make.

-

Choose a unique name: Your church’s name should reflect your mission and resonate with your community. Be sure to run a business name search with your state’s Secretary of State to confirm availability.

-

Assemble a board of directors: Recruit trusted individuals who share your vision. They will be legally responsible for governance, finances, and ensuring compliance.

Step 1: Incorporate Your Church as a Legal Entity

Forming a nonprofit corporation provides legal protection and credibility.

-

File Articles of Incorporation: Draft and submit this document with your state. Be sure it includes:

-

A clear purpose statement (including the authority to ordain ministers, if applicable)

-

A dissolution clause

-

State and IRS required language

-

-

Hold an organizational meeting: The board should formally approve the incorporation documents, adopt bylaws, and appoint officers.

Step 2: Obtain a Federal Employer Identification Number (EIN)

Your EIN (or F.E.I.N.) is the tax identification number for your church. With it, you can:

-

Open a bank account in the church’s name

-

Receive donations

-

Handle payroll if you hire staff

⚠️ Important: Incorrectly applying for an EIN can cause IRS issues later, especially when seeking 501(c)(3) approval. Get this step right from the start.

%schedule-a-call-cta%

Step 3: Draft and Adopt Bylaws

Your bylaws act as the rulebook for your church’s governance and decision-making. Outside of the Bible, this will be your most important governing document.

Bylaws should cover:

-

Membership rules

-

Leadership structure

-

Conflict resolution processes

They also protect against public accommodation laws that may conflict with your church’s First Amendment rights. Because laws change over time, your bylaws must be reviewed and updated periodically.

Step 4: Establish Policies and Procedures

Strong policies and procedures ensure day-to-day compliance and accountability. These documents go beyond bylaws to provide operational guidance.

Essential church policies include:

-

Accountable reimbursement policy

-

Conflict of interest policy

-

Benevolence policy

-

Indemnification policy

-

Anti-terrorism policy

These help safeguard your church financially, ethically, and legally.

Step 5: Apply for 501(c)(3) Tax-Exempt Status

While churches are generally considered tax-exempt automatically, obtaining an official IRS determination letter is highly recommended. This status allows you to:

-

Access grants and larger donations

-

Give donors confidence in tax-deductible giving

-

Protect your church’s long-term sustainability

Be prepared:

-

IRS Form 1023 is 25+ pages and can take 100–150 hours to complete.

-

Supporting documents (bylaws, financials, narratives) often bring the total to 50–70 pages for churches.

Because this process is so complex, many pastors partner with specialists—like StartCHURCH’s StartRIGHT® Service—to ensure accuracy and peace of mind.

Meet State-Specific Requirements

Beyond federal law, many states have additional requirements:

-

Sales tax exemption: 31 states offer exemptions, but require a separate filing.

-

Franchise tax: Some states levy annual corporate franchise taxes, but churches may qualify for exemptions.

-

Charitable registration: If your church solicits donations, you may need to register with your state’s charities division.

Prepare for Operations

With the legal foundation in place, you’re ready to launch ministry activity.

-

Open a bank account using your EIN and incorporation documents

-

Secure a place of worship (start small and scale as you grow)

-

Build a launch team for services and outreach

-

Develop a financial plan covering staff, facilities, insurance, and ministry programs

Final Thoughts: You Don’t Have to Do This Alone

Starting a church involves much more than hosting services—it requires careful planning, legal compliance, and a strong organizational structure. While the process may seem overwhelming, you don’t have to walk it alone.

At StartCHURCH, we’ve helped thousands of pastors and ministry leaders establish a firm foundation for their churches and ministries. From incorporation* to bylaws* to 501(c)(3) approval, our specialists are here to guide you every step of the way.

For more information on how to start a church or ministry, call us today at 770-638-3444.

%startRightChurchFocused-cta%